This essay presents Domini’s holistic approach to sustainability challenges and how we evaluate our portfolio through the lens of global forest impact.

An Early Read Out of Domini’s Forest Project

July 30, 2020

The 2020s opened with convergent and connected crises unfolding on a global scale: the climate emergency, the coronavirus pandemic, and incidents of systemic racism boiling over into the mainstream public consciousness. Despite the continuing tragedies and challenges we face in our own lives, work and communities, this disruption may be cause for hope. It brings a rare opportunity for change right when we need it most and a lesson long overdue: we are all connected.

The health of the planet, the health of people, and the health of the economy all depend on each other. We can’t reopen our economy without first making our communities healthy. We can’t avoid future pandemics if we continue to destroy the natural environment. Favoring one system at the expense of another doesn’t work either. With this truth and opportunity in hand, it is incumbent on all of us to find our way to a more sustainable future.

Domini has been striving to do just that since the inception of our first mutual fund in 1991 by taking a holistic approach to sustainability challenges. We look at the full picture of a company, not just financial statements, to understand its risks and opportunities – an approach now widely accepted as best practice. We also work directly on addressing the biggest risks that face our planet, people and our portfolios.

The health of the planet, the health of people, and the health of the economy all depend on each other.

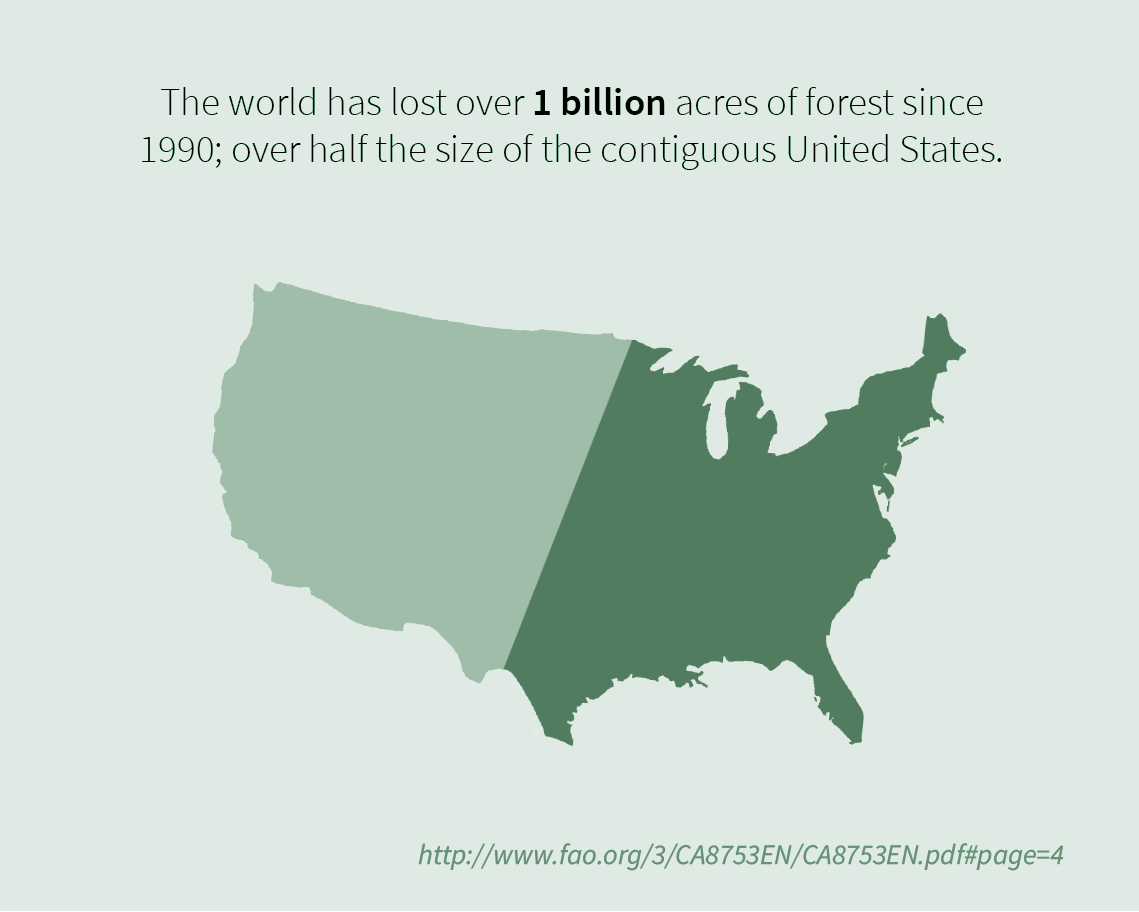

We launched our Forest project in the hopes that we would build a model to better address those large, intractable, foundational issues. In the context of forests, the dynamics are clear. We all – including companies – depend on forests, whether it’s because they stabilize the global climate, provide a home for pollinators, create rain, or just help us connect with nature. The value may be hard to ‘price’ but it’s not hard to understand. Still, we lost the equivalent of a soccer field of forest every 4 seconds in 2019.

The world appears to be caught in this losing paradox: Forests provide essential value on which we rely and offer solutions to the biggest problems we face, yet we continue to participate in their destruction, as consumers, as investors, and as a global community. We can observe a similar paradox in the coronavirus pandemic: ‘essential’ frontline workers on whom we rely for our health, food, deliveries and so much more are lacking the basic protections they need in return.r(See domini.com/covid19-statement .)

The world appears to be caught in this losing paradox: Forests provide essential value on which we rely, yet we continue to participate in their destruction.

In order to find the answer to why this paradigm continues and in search of a more sustainable future, we looked across our portfolios for the industries that most clearly embody the forest paradox: companies that negatively impact forests but depend on forests for a key resource or service. Those companies have the strongest business case to innovate and take action.

While the work is ongoing, some pieces of that picture are coming into view. Out of our conversations with those companies emerged a profile of a forest value creator, i.e. a company that delivers returns to shareholders by creating value alongside and for other stakeholders rather than relying on extracting or destroying value for profitability.

Crucially, we went beyond asking companies to be neutral with respect to the forest, and instead focused on identifying those that have aligned their business strategies with solutions for shared value creation that we can help to accelerate. However, this analysis is not limited to forests. Indeed, we are seeing many of the same characteristics emerge in companies’ responses to the coronavirus pandemic as well.

To be sure, these companies have not cured the world or even themselves of destroying value in pursuit of profit. The examples that arose are largely pilot projects not yet implemented at scale, but they show a commitment to innovation and offer a potential road map to a sustainable economy, where systems like forests and communities are stronger, healthier and more resilient for the benefit of all stakeholders (companies included).

Forest Value Creators

The following characteristics were gleaned from a series of conversations with portfolio companies and comprise the profile of a forest value creator (FVC) , a company that has aligned its core business strategy with sustainable and shared value creation.

Seek solutions proactively.

Obstacles to action and excuses for inaction are plentiful, for example, what some psychologists have called the “It’s Not My Problem” problem 1 when it comes to climate change. FVCs act, they are willing to lead.

Recognize the scale and larger scope of the problem.

System level risks like deforestation, climate change and the coronavirus are not addressable by individual actors. FVCs take responsibility for their impact but recognize that the problem to be solved goes beyond their organization.

Cooperate with communities and nature.

Working with the flow of existing systems helps to leverage natural efficiencies and avoid unintended consequences. FVCs rely on practices like regenerative agriculture and empowering emergent community and worker organizers.

Collaborate vertically, horizontally and across sectors to scale up solutions.

Agility and resilience are built on networks. FVCs work with diverse and outside-the-box partners to innovate and scale solutions.

Focus on impacted communities first and adopt an inclusive approach.

Designing for and from the margins leads to inclusive solutions that better serve all stakeholders. FVCs can deploy learnings from all corners to develop solutions more likely to gain traction and succeed.

VALUE CREATORS IN ACTION

Lowe’s Home Improvement: Building Resilient Cities

Lowe’s partnership with The Nature Conservancy (TNC) on resilient cities provides an example of a shared value creator in action. 2 The project started with three pilot programs in Houston, Louisville and Philadelphia 3 that leverage planting trees and gardens to address heat islands, public health, and stormwater surges. In Louisville, for example, the “Green Heart Project” partnered with over 20 community organizations to plant 8,000 trees and shrubs and conserve over 100 ash trees. 4 It will study the long-term effects on air quality and noise pollution and the corresponding health impacts for the community. Urban green spaces can also combat excessive heat, slow flooding, decrease stormwater runoff, and increase property values. 5 More resilient communities and homes may also be eligible for improved insurance premiums.

While this approach clearly leverages natural solutions and key partnerships, it is also aligned with Lowe’s core business. Lawn and garden, seasonal and outdoor living, hardware and tools together represent 30% of its revenue base. Do-It-Yourself (“DIY”) homeowners represent a key customer base. Through strategic marketing and education campaigns, Lowe’s can drive sales and build brand engagement and loyalty with key customers by deploying sustainability solutions that generate collateral benefits for other members of the community. The project has delivered value not just to the company’s shareholders, but also to its consumers, their communities and their cities.

Other Value Creators Respond to a Pandemic

While corporate responses to the coronavirus are still unfolding, some companies were quick to find creative ways to leverage their core business and networks to help address the crisis. Old Mutual, an insurance company in the UK, provided free life insurance to 25,000 frontline workers through this fall. Helvetia Holding, an insurance company in Switzerland with its own real estate portfolio, waived rents for some tenants especially small and mid-size companies that haven’t been able to operate during the pandemic. Companies like Zoom provided free unlimited access to its services and offered support for users quickly transitioning to remote work like schoolteachers and mental health providers. Tingyi Holdings Corp., a leading producer of instant noodles in China, captured market share by cutting the price of its products.

Each of these actions created value for the companies – whether through protecting its value chain, its workforce, building brand awareness and loyalty, or capturing market share – while also creating value for other stakeholders.

As we recognize the interconnectedness of our people, planet, and profit, we see the characteristics of a Value Creator as a model to persuade companies to contribute to the social, environmental and financial systems that we all rely on for our health and well-being. Given the scale and scope of the challenges we face, we all need to be value creators for a healthier, safer and stronger future.

Learn more about the Domini Forest Project

Sources:

1. “The Psychology of Climate Change Denial.” The psychology of climate change denial | APS. Accessed August 24, 2020. https://www.psychology.org.au/…

2. “Building Healthy Cities with Lowe’s.” The Nature Conservancy. Accessed August 24, 2020. https://www.nature.org/en-us/lowes-stewardship/.

3. “Philadelphia.” The Nature Conservancy. Accessed August 24, 2020. https://www.nature.org/en-us/lowes-stewardship/philadelphia/.

4. “Green Heart by the Numbers.” The Green Heart Project. The Nature Conservancy. Accessed August 24, 2020. https://tnc.app.box.com/s/yfip2ixbtayg6uwobtgb2rw5ni14skkd.

5. “Louisville.” The Nature Conservancy. Accessed August 24, 2020. https://www.nature.org/en-us/lowes-stewardship/louisville/.