Companies Drive Deforestation. Investors: Getting to Forest-Positive

Most tropical deforestation is driven by just four commodities: palm oil, cattle, soy, and wood products. These products are produced and bought by major corporations and find their way into our everyday lives. With fires raging in the Amazon and Indonesia, as well as Australia and California, many people are asking what they can do to protect the world’s forests. Investors, both institutional and individual, have a huge role to play in preserving and enhancing forests. Investors can pressure companies to halt deforestation in their supply chains and can divest from companies that engage in forest-harming practices. Investors that fail to address deforestation in their portfolios are not only exposed to cross-sector risk, but also miss the opportunity to help create the much-needed forest solutions we need.

The unprecedented forests fires have reminded us how much we care about forests and the animals that inhabit them. These disasters have also highlighted how much we depend on forests for clean air and a stable climate. Forests’ capacity for carbon capture could be a powerful solution to climate change, but currently an estimated 15% of all greenhouse gas emissions result from deforestation. In addition, deforestation is a threat to biodiversity and rural and indigenous communities that depend upon forests for their livelihoods.

Supporting Forests

Domini Impact Investments has a long history of working to support forests. We both avoid investing in drivers of deforestation and work to create sustainable practices. In practice, this goal means we avoid investments in industrial agriculture and other environmentally intensive practices that can have detrimental impacts on land and water resources, including forests.

In Brazil, for example, most forest loss is driven by land-clearing, including intentional fires, to increase agricultural production. Much of this land-clearing is illegal but persists due to Brazil’s poor enforcement of environmental laws and insufficiently resourced regulatory agencies. Industrial farming in Brazil is centered on large-scale cattle ranching and soy plantations. Due to violations of environmental regulations including widespread deforestation, as well as corruption, encroachment into indigenous territory, and the waste and emissions in meat production, we avoid companies engaging in soy and cattle farming in Brazil and companies that export and trade these products.

Instead, we seek investments that promote the protection and preservation of forests, wildlife and ecosystems. We favor companies that integrate sustainable practices into their global supply chains, such as using rigorous sustainability certifications for timber. We also look for companies that are reducing pollution of air and waterways, understand and report on how their operations impact forests and local ecosystems, and responsibly manage relations with local and indigenous communities. We recently reviewed our proprietary key performance indicators across all sectors to codify risks related to deforestation to help us better identify companies that are having a positive impact on forests.

To support solutions to forest loss, we raise awareness of the crucial functions of forests with corporations and industry partners. We push companies to achieve deforestation-free supply chains. We work with portfolio companies, including food manufacturers and retailers, to reduce demand for products that cause deforestation and help them to work with their suppliers to create deforestation-free supply chains for inputs.

Many companies we approve for investment are already having a positive impact. These include Klabin SA, a Brazilian packaging and agroforestry company. Klabin has 100% FSC-certified forests, the first company in the Southern Hemisphere with the certification, and the company’s production facilities are also FSC-certified. We consider FSC to be the best forestry standard, as it includes biodiversity and community factors in its assessment. The company maintains 48% of forest area for conservation and maintenance of biodiversity in accordance with Brazil’s Forest Code, which requires 20-80% of holdings be set aside as legal reserves, depending on plot size and location. Klabin uses a mosaic concept for forest management, wherein pine and eucalyptus plantations are mixed with areas of native forests in order to create ecological corridors.

Good governance, including strong legal protections and enforcement, is crucial for sustainable forests. Apart from direct company and sector work, we have supported legislation that would require companies involved in public procurement to have no-deforestation policies and enforcement mechanisms in place. We recently organized investor support for the California Deforestation-Free Procurement Act. The Act would require companies doing business with California to have policies, certification and public disclosure regarding deforestation and human rights. This disclosure would help investors identify companies that are fulfilling their zero deforestation commitments.

Stewarding Forests

Companies and investors must go beyond avoiding deforestation to creating solutions and restoring forest landscapes. In our discussions about forests with portfolio companies, those that have the best forest practices recognize risk exposure goes beyond their own impact and supply chain. They know that deforestation is complicated and try to work with many partners, including vertically, horizontally and across sectors to scale change. And they recognize that dire nature of deforestation means they must seek solutions proactively, without waiting on peers or government action.

This year we engaged with 68 companies in our portfolios that both impact forests and depend on them, whether for forest-derived products or ecosystem services. We had positive responses from many corporations, holding discussions with them about how they consider the value they obtain from forests and how they can better work to steward it. Through these dialogues we have begun to identify corporate actors that are effectively protecting and supporting forests and some of the specific practices and qualities that set them apart.

Investors must also fundamentally change their mindset about how they consider forest value. We find two root causes underlying continued deforestation. First, today’s focus on short-term profit leads to practices that extract value while perversely undermining the very source of the value. Second, without an appropriate value and cost framework, investors and corporations do not feel the need or responsibility to steward the forests we all rely upon.

We are uniquely positioned to make the case to our peers that they must do more to identify and manage forest value. Carole Laible, our CEO, addressed audiences at Responsible Investor New York about the connection between forests and food security. She explained the urgent need for investors and companies to understand how much value their operations receive from natural ecosystems, especially forests, and called on the attendees to steward environmental and social systems. If we recognize how much value we receive from ecosystems, we can begin to foster and enhance that value, with benefits for our businesses, employees, rural communities, and the environment.

Carole also spoke to financial advisors at a Money Management Institute event, explaining how we consider and act on forests’ economic value and work to improve how deforestation is addressed. She illustrated how investors must go beyond mitigating harm to forest through portfolio operations to positively enhancing forest systems in order to preserve and enhance the value in their investments.

To send a public message in response to the surge in fires in the Amazon rainforest this summer, we joined 230 investors representing over $16 trillion in assets to call for urgent action on the fires in the Amazon. The statement asked investors and corporations to take actions ranging from public statements to making commitments about supply chain practices.

Moving to a Forest-Positive Economy

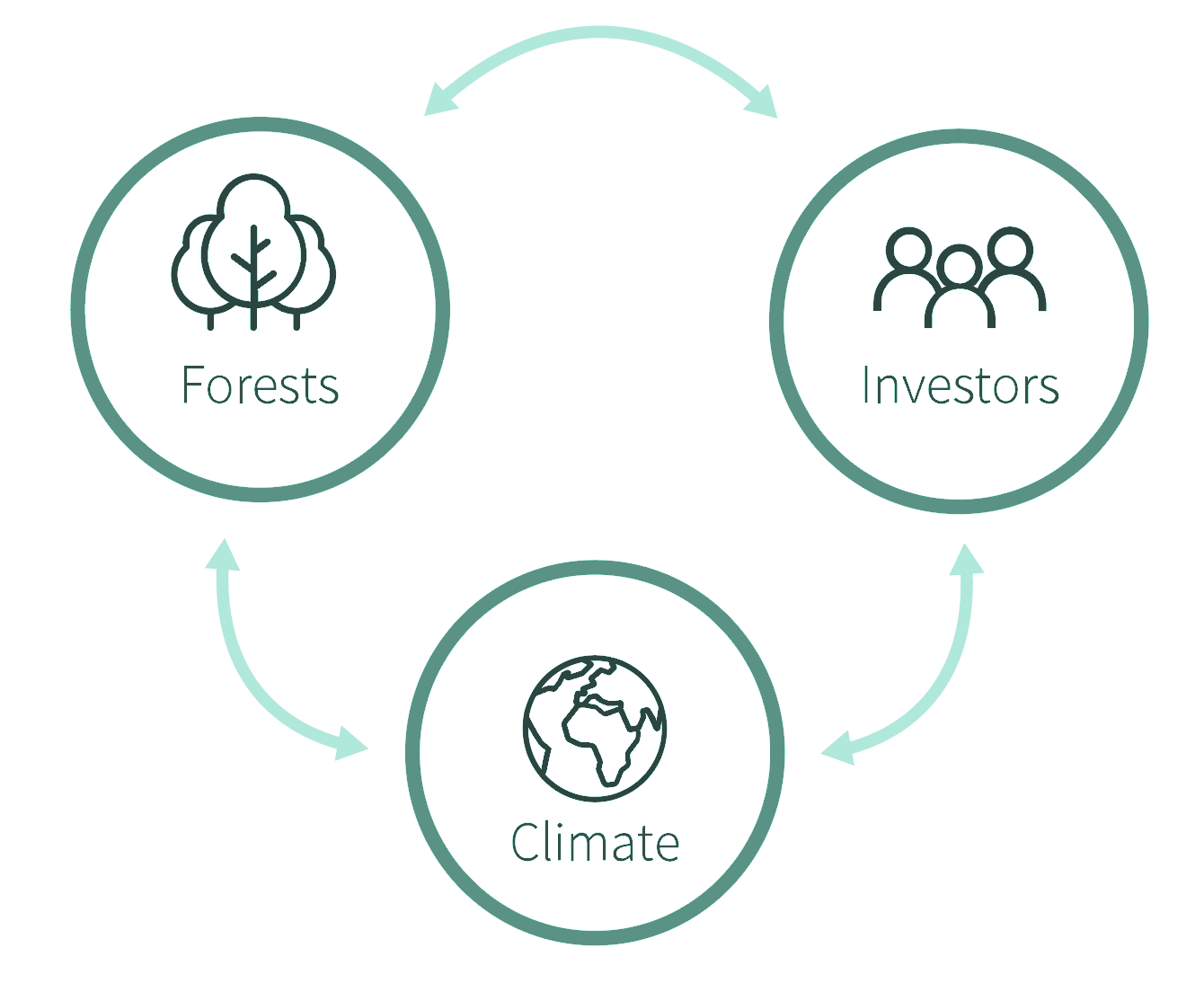

Large corporations and their investors often drive deforestation. Through conventional investing practices, investors contribute to the worsening of profound environmental change that poses systemic environmental risks with potentially adverse impacts on their holdings across all asset classes. These investors should consider their impact on forests when making investment decisions. Investors can encourage proper valuation of natural services from forests and inclusion of reforestation in climate change strategies, while helping corporations not only avoid harming forests but positively impacting them.

Domini recognizes forests’ critical role in global environmental and social systems. We can and do drive change, not only helping to combat commodity-driven deforestation but encouraging reforestation, biodiversity conservation, and sustainable development. We will continue prioritizing forests as a key foundation for a sustainable economy, divesting when necessary and working with our partners and portfolio companies to foster forest health.

If we recognize how much value we receive from ecosystems, we can begin to foster and enhance that value, with benefits for our businesses, employees, rural communities, and the environment.